THE EURIBOR, FROM A DANGEROUS ENEMY TO AN ALLIED OF MORTATGES

The euribor, probably, is the interest rate most commonly used in Spain to determine floating-rate mortgages. Do you know how it works?

The economic crisis and the euribor; if we decided to talk about this indicator, it is basically due to two factors:

1. Traditionally, it’s been the most used when it comes to Spanish mortgages.

2. Its tendency has varied through the crisis period, plummeting from its maximum value at 2008.

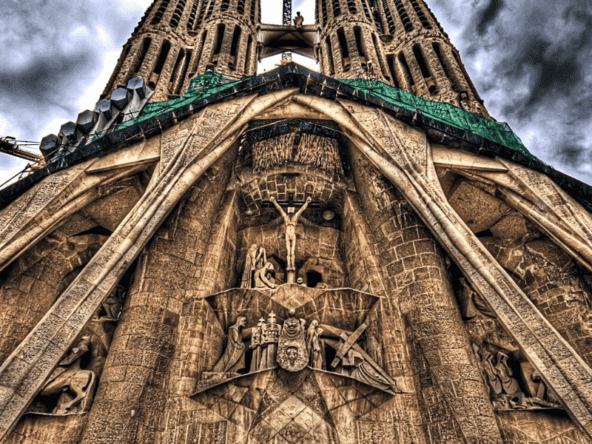

Before the crisis started and while it lasted, it became a truly nightmare for those who dared to buy a property in Barcelona. Was this your case?

The mortgaged ones, experienced how its rates increased to the point that paying the quotes became almost impossible. This changed when the European Central Bankintervened and there was an increasing of the credits.

When was created the euribor?

The “Interbank Offered Rate” is a European rate that was set on 1999 along the Euro. That’s why the eldest people consider it a strange indicator while younger population has grown up with the euro.

It was considered a potential initiative which would allow the standardization of the European credit market, although, you will be able to proof, that it failed.

Historical evolution of the Euribor; it all exploded back on 2002 when rates plummeted, converting into more economical the financing.

On 6th 2008, it started to increase absurdly, it reached almost 5393%. The European Central Bank, tried to handle the upcoming crisis by reducing the interest rates what lead to, almost until 2016, negatives rates.

Nowadays, this is the scenario that we are placed at; the values are located near negative points, so if you want to ask for a credit, this is the moment.

Future evolution; The European Central Bank, has warned that the rates will continue to be negative for, almost another 5 years, meaning that until 2023 or 2024 it will not increase again and if it does, it will be a slow increase process.

As you know, the European Central Bank is a really strong and potent one as not only, helped to fix the indicator’s tendency but as well, participated, from 2011 to 2013, in investigations where it was found that some entities manipulated the indicator.

In fact, there has been proposed for 2020, a change for its calculation.

Definitely, if you want to buy a house, the credit is more economic than ever. Lots of people take the chance to ask for a mortgage and rent their house in Barcelona; this helps them to pay their quotes and obtain extra incomes.

Did you know that you could use this way the euribor? Contact us for further information.